The Medicare Advantage market is at an inflection point. The past few years have seen unprecedented enrollment growth, fueled by a rapidly increasing senior segment and an enabling regulatory environment. While growth this year remained strong, it was slower than in years past. What’s more, conflicting trends converging on Medicare Advantage organizations (MAOs) may result in more tempered growth going forward.

Meanwhile, the big keep getting bigger. United, Humana, and CVS/Aetna continue to amass lives at a breakneck pace. By contrast, many Blues1 and nonprofit plans that serve this market continue to be left behind as market growth exceeds their own enrollment gains.

The following changes are shaping the market:

- Enrollment trends: Half of Medicare-eligible individuals are now in Medicare Advantage plans. The market grew by 1.7 million beneficiaries (+5.4%), slowing down from the previous year’s record growth of 2.7 million (+9.4%). Notably, for-profit carriers like United, Humana, and Aetna collectively captured 1.4 million new members: 86% of the total market’s growth.

- Special Needs Plan (SNP) growth: SNP enrollment has surged, adding 1.2 million members. Nearly 7 in 10 new Medicare Advantage enrollees opted for SNPs. This growth is particularly pronounced in Chronic Condition SNPs (C-SNPs). The top 5 plans now represent 77% of the SNP market.

- Plan options and preferences: The number of plan options are roughly flat from the previous year, with the average senior having access to 44 plans. In contrast, the trend of the past five years has been 80% growth. Preferred provider organizations (PPOs) have increased, constituting 43% of all plans offered, up from 31% in 2019.

- Market dynamics and quality: Medicare Advantage enrollment and social vulnerability are related. Counties with higher vulnerability scores show greater penetration rates (53%) compared to counties with lower scores (45%). Meanwhile, quality remains a concern as plans struggle to maintain quality scores. Average star ratings continued their decline and this year approximately one-quarter of beneficiaries are enrolled in a plan with less than four stars.

- Market outlook and executive sentiment: Health plans face recent market challenges, including declining payment rates, growing medical cost pressures, and an expanding regulatory burden. But 79% of plan executives express optimism about the next five years, expecting neutral or positive overall outcomes. 84% anticipate membership growth equal to or greater than the current year, indicating confidence in the stability and growth potential of the market.

While growth has slowed, the market remains robust

A record 33 million individuals are now enrolled in Medicare Advantage

For the first time, more than half of the country’s Medicare population is enrolled in a Medicare Advantage plan. This reflects growth of nearly 1.7 million total beneficiaries (+5.4%) since 2023, bringing the total Medicare Advantage enrollment up to 33 million total beneficiaries out of 65.9 million Medicare-eligible individuals.

Medicare Advantage growth and penetration changes by year

Meanwhile, Original Medicare enrollment contracted by 515,000 beneficiaries, a net effect of an additional 1.2 million total Medicare beneficiaries, below historic average overall growth.

Two trends are noteworthy: First, Medicare Advantage enrollment growth slowed from recent years of steady increases. Second, Original Medicare’s losses, while still profound, have slowed too. Original Medicare lost 1.3 million members each of the past two years, yet only 515,000 this year. The data still shows a strong preference for Medicare Advantage over Original Medicare, but that appears to be tempering.

Annual enrollment growth differences between Original Medicare and Medicare Advantage

Enrollment in 26 states is now 50% or more in Medicare Advantage

State-level dynamics continue to play out. 26 states now have more than half of their Medicare enrollment in a Medicare Advantage plan. Under-penetrated states again saw the greatest growth rates. States that had higher rates of adoption going into the year had slower growth rates. While more than 30 states had double-digit growth last year, only a handful hit double-digit growth this year (all states with low penetration).

A state’s existing penetration rates and Medicare Advantage enrollment growth rate are two key metrics that provide insight into the state’s market maturity. The map below shows the 2024 Medicare Advantage penetration rate and the year-over-year growth in enrollment for each state.

Medicare Advantage penetration and growth rates by state

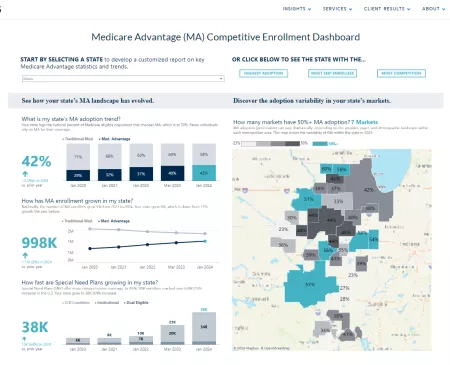

Explore enrollment trends and competitive dynamics by state

Use our Medicare Advantage competitive enrollment dashboard to explore the meaningful dynamics unfolding in each state.

Special needs plan enrollment grew nearly 22%

SNPs had another record year. SNP enrollment grew by nearly 1.2 million members, led again by growth in the Dual-Eligible SNP (D-SNP) segment. Overall, SNP enrollment grew 21.5% from the prior year and has grown an average of 18% per year over the past five years. Notably, SNPs captured nearly 7 in 10 new enrollees this year. Today, nearly 1 in 5 Medicare Advantage enrollees have coverage through an SNP. This reinforces the segment’s importance to the Medicare Advantage sector and the imperative for health plans to serve this large and high-growth population.

Within the SNP products, Institutional SNP (I-SNP) enrollment climbed steadily. Chronic Condition SNPs (C-SNPs) saw a tremendous jump in enrollment, growing 42% from 450,000 to 643,000, after several years of more muted growth. This growth largely accrued to United and Humana, which grew 37% and 174%, respectively. They make up more than 60% of the C-SNP market.

SNP enrollment continues to grow rapidly

SNP growth is again accreting to the top five plans, which collectively represent 77% of the market, up from 65% five years ago. Of note, Aetna has dramatically increased its presence in this market, now accounting for nearly 6% of all enrollment, up from less than 1% in 2019. During AEP, Aetna saw more than a quarter and Humana more than half of its net-new Medicare Advantage members enroll in SNPs. This product remains a focus area for growth for national health plans.

SNP growth accretes to select few plans

Plan options for consumers are plateauing

One noteworthy trend in recent years has been the overwhelming number of Medicare Advantage plans available to seniors. For the first time, we see a flatlining of Medicare Advantage plans available nationally. This year, there were 5,349 plans in the market, up marginally from 5,333 last year. Of note, the unique number of non-SNP Medicare Advantage plans fell slightly.

Total number of unique plan options available

PPO plans continue to proliferate within non-SNP Medicare Advantage plans. This year, 43% of plan options were PPOs, up from 41% last year and only 31% in 2019.

Share of PPOs and HMOs among plan options nationally

Finally, at a local level, plan options have flatlined as well. The average number of plan options by county rose only by one plan option. Measured within a given state, that number fell to 162 this year, down from 165 the year prior. That said, plan options have increased 80% and 49% by county and state, respectively, since 2019. That presents a dizzying array of options for seniors.

Similar to plan options, the prevalence of supplemental benefit offerings (which have increased significantly in recent years) seems to be slowing and even declining for some benefits, suggesting that “more is not always better.” The proliferation of both plan options and supplemental benefits is driving proposed regulations from the Centers for Medicare and Medicaid Services related to agent/broker compensation, D-SNP integration, and supplemental benefit reporting.

Plan option availability to the average Medicare-eligible individual

The competitive shift continues at a rapid rate

For-profit plans continue to capture greater market share at the expense of nonprofit plans

For-profit insurers now account for 73.5% of all Medicare Advantage enrollment, up from 73.0% the year prior and 68.7% in 2019. This 4.8 percentage point share increase translates to an annual growth rate of 9.8%. Meanwhile, nonprofit plans continue to see share declines, although their enrollment is still growing. However, Blues plans collectively have maintained share in recent years, losing only 0.1 market share point this year.

Share of enrollment by plan cohort by year

United, Humana, and Aetna gained while Centene and Elevance declined

82% of this year’s 1.7 million new beneficiaries accrued to for-profit plans, 9% to nonprofit Blues plans, and 9% to non-Blue nonprofit plans.

Blues and nonprofit plans once again accounted for little overall enrollment. The Blues collectively added 147,000 members, led by HCSC and BCBSMI’s growth of 40,000 and 30,000 members, respectively. Nonprofit plans added a collective 155,000 members, led by Kaiser Permanente and Healthfirst.

Distribution of 2024 enrollment growth by plan cohort

Stark trends exist among the top 10 largest for-profit plans. United, Humana, and Aetna collectively enrolled 1.4 million seniors out of the total 1.7 million market growth, together accounting for 86% of all new enrollment. The fact that United, Humana, and Aetna enrolled a similar number of members represents a departure from United and Humana’s previous enrollment dominance.

When looking at AEP data only, Aetna’s performance is also significant: The plan grew by 476,000 lives, garnering 60% of net-new Medicare Advantage lives during this important selling period. United and Humana also grew during AEP (119,000 and 112,000 lives, respectively). But they grew below the overall AEP growth rate of 2.4% and below their previous individual AEP growth rates. Without the inclusion of Employer Group Waiver Plans (EGWP) membership, United’s growth during AEP was essentially flat (+9,000 or 0.1%), indicating that all its growth came from outside the individual Medicare Advantage market during AEP.

Looking at the full year of 2023, Centene and Elevance lost 212,000 and 25,000 members, respectively. Centene’s membership losses were expected, given its challenges with stars performance and our analysis in last year’s report showing the connection between stars changes and enrollment growth.

Finally, assuming Cigna completes its announced divestiture of its 587,000 member Medicare Advantage business to HCSC (a regional nonprofit Blue plan), this will be Cigna’s last year on this list.

Enrollment and share changes for top 10 largest for-profit Medicare Advantage plans

Devoted Health and Alignment Healthcare again lead start-up plan growth

Start-up plans tracked in our index now account for 2.0% of all Medicare Advantage enrollment nationally, up from 1.8% last year and 1.1% in 2019.2

Start-up plan market share

Growth in this segment was led principally by Devoted Health and Alignment Healthcare, which together added 109,000 members, while the cohort overall added 101,000 members. This dynamic was driven by plans such as Bright and Oscar retreating from markets and therefore reducing membership among this cohort.

Start-up plan membership changes

Provider-sponsored health plans continue to struggle

While provider-sponsored health plan (PSHP) Medicare Advantage enrollment has grown in recent years, the growth has underperformed the market at large and resulted in a continued loss of market share. PSHPs made up 13% of all Medicare Advantage enrollment this year, down from 17% in 2019.

This trend is surprising, given physician influence over patient enrollment decisions. PSHPs are predominantly nonprofit plans aligned with one or several health systems in a market. Our research shows that 62% of primary care physicians recommend specific health plan products to their patients, and approximately half of patients heed that advice.

The continued erosion of PSHP membership in Medicare Advantage means that these plans are missing out on the nation’s largest growth segment and are likely not capturing the full value of plan-provider integration for growth.

Provider-sponsored health plan enrollment and share growth

Quality and societal shifts will shape Medicare Advantage’s future performance

Quality rating performance continues to decline

2024 marked another year of declining average star ratings—Medicare Advantage plans collectively fell by approximately 0.1 star, when weighted by membership. Several interesting trends are evident among the largest plans. Of note, Kaiser lost an entire star, bringing the health plan to four stars from its historic five. United, Cigna, and Elevance all saw continuous declines in their star rankings. Centene, which suffered a massive decline in 2023, saw its ratings stabilize.

Plan star trend by payer: 10 largest plans

Approximately three-quarters of all enrollment was in a four- or five-star plan, a slight increase from last year. However, five-star plan enrollment declined abruptly. In 2022 and 2023, 27% and 22% of all membership was in a five-star plan. This year, only 7% of membership is in a five-star plan. Most importantly, 24% of membership was in a plan with fewer than four stars. This represents a continued decline from historic enrollment performance.

Enrollment distribution by star rating

Socially vulnerable seniors choose Medicare Advantage for coverage

Medicare Advantage is more popular in areas with higher levels of social vulnerability. The Social Vulnerability Index (SVI) is a tool developed by the Centers for Disease Control and Prevention (CDC) to assess and quantify the social vulnerability of communities. It considers many factors across four key categories (socioeconomic status, household composition, minority status, and housing and transportation) to identify geographic areas that may be more susceptible to the negative impacts of disasters and public health emergencies. We tested the presence of Medicare Advantage against the level of SVI in counties to understand the relationship between the two metrics.

A higher overall vulnerability (or SVI) is associated with a higher Medicare Advantage penetration. In 2024, 53% of individuals in the most vulnerable counties elected Medicare Advantage, compared to 45% in counties deemed least vulnerable. This difference persists for two of the subcategories of SVI: Counties with lower socioeconomics or challenging housing and transportation show considerably higher Medicare Advantage penetration. Of note, the SVI indicator for minority status had little relationship with Medicare Advantage uptake.

Medicare Advantage penetration by social vulnerability

Medicare-eligible growth will slow but continue outpacing other age segments

Medicare broadly has seen unprecedented growth over the past decade. That has benefited Medicare Advantage as the senior segment multiplies and Medicare Advantage increasingly becomes its preferred method of coverage. A question we hear often is: When will growth stop?

2025 will mark the highest number of people in the United States turning 65. However, Medicare enrollment growth overall likely peaked in 2020, with 1.5 million net-new Medicare enrollees, compared to only 1.3 million net-new enrollees this past year. This dynamic of record age-ins but slowing 65+ growth was likely driven by the precipitous decline in life expectancy starting in 2020. Accordingly, we expect that the pace of growth in the 65+ population will begin to slow moving forward as 65-year-old age-ins peak and life expectancy remains below pre-pandemic levels.

Between 2020 and 2025, we will see five-year growth of approximately 16% (+3.0% per year), compared to 22% growth (+4.1% per year) in the five years leading up to 2020. Looking forward to the next five years, we expect 12% growth (+2.3% per year) between 2025 and 2030.

Starting in 2040, we expect growth to flatline in the 2% to 4% range over five-year periods (0.4% to 0.8% growth per year). That said, the senior population will continue to grow at a faster rate than other population segments for the foreseeable future.

Population change by age band

5 Year % Growth by Age Group for 2010-2060

Medicare Advantage executives remain optimistic despite recent industry headwinds

Many headwinds converged last year, including new restrictions on marketing, continued declines in quality ratings, and rapid increases in medical costs for beneficiaries. Because these compounding factors are expected to dampen enrollment growth, they have created a cloud of uncertainty over the outlook for Medicare Advantage. To understand the impact this may have prospectively, we surveyed line of business leaders at leading Medicare Advantage plans to get a sense for their outlook in 2025.

Medicare Advantage Growth Expectations for 2025 Plan Year

Medicare Advantage leaders are optimistic, with 84% expecting their own plan’s membership growth to be consistent or higher next year. 74% expect the same of the industry.

Despite this optimism, plan leaders are more likely to believe plan benefits will shrink, pointing to several forces driving this reduction and outlook uncertainty. 48% believe benefits packages will shrink, while only 16% believe they will improve. 37% expect them to remain unchanged.

Benefit Package Changes for 2025 Plan year

When asked about issues affecting next year’s enrollment, half of executives listed overall profitability, medical cost growth, and stars quality reductions as their greatest concerns. Respondents also expect legislative and regulatory uncertainty and risk model changes to impact enrollment performance.

Top drivers impacting Medicare Advantage enrollment for 2025 plan year

Finally, this short-term optimism extends to the next five years. Overall, 79% of plan leaders believe the Medicare Advantage outlook is neutral to positive.

Medicare Advantage Outlook for the Next 5 Years

Implications for the market

Medicare Advantage growth persists, driven by aging demographics and the continued consumer attraction compared to Original Medicare. While we anticipate this trend to continue broadly, we also expect headwinds to cloud the outlook on this market beginning in the 2025 plan year. In addition to competition and slowing growth, revenue cuts and regulatory scrutiny may impact market opportunity.

To succeed in this environment, health plan executives should consider three strategies:

-

Create sustainable growth and performance: Striking the right balance of growth and sustainability will require plans to deploy a performance improvement strategy that incorporates underlying program economics, key revenue and cost levers, and a strategic focus on growth. Plans should target growth where they have a “right to win” across distribution channels, Medicare Advantage member segments, and geographic markets. Sustainable performance must also account for the impacts of regulatory changes on network providers, such as their level of risk assumption and contracting arrangements.

-

Cultivate engagement and retention: Plans will increasingly need to focus on member engagement to ensure retention. These efforts must begin from initial onboarding and continue with strategic touchpoints across the member journey (informed by member needs and health status). Retention will be critical for return on investment as plans realize improvement efforts related to risk adjustment, star ratings, and medical cost management.

-

Pursue diversification and flanking: In the face of the competitive individual and D-SNP markets, plans should consider “flanking” strategies that will allow them to tap adjacent and new local markets. Economics of these adjacent markets (e.g., C-SNP, veteran- and military-focused plans) can create greater opportunity for favorable margins when the products are well managed.

With so much industry and consumer investment in Medicare Advantage, stakeholders must carefully consider the market dynamics and challenges as they seek to support the unique needs of this market. Adapting their strategies in the increasingly complex and competitive landscape will be essential for ongoing success.

Analytic Methodology

Medicare Advantage enrollment, plan, and pricing data from the Centers for Medicare and Medicaid Services (CMS), January 2019, January 2020, January 2021, January 2022, March 2023, and January 2024. Medicare fee for service (FFS) enrollment data from CMS, January 2019 to January 2024. Includes all Medicare Part C Plans, including Regional PPO and Medicare Cost; certain analyses limited to 50 states and DC. Plans categorized as for-profits, Blues, and nonprofit based on Chartis analysis. For market-level analyses, any counties not part of a CBSA (defined by the U.S. Office of Management and Budget) or that had less than 11 Medicare FFS enrollees were excluded. Special Needs Plan (SNP) data from SNP Comprehensive Reports January 2019 to January 2024. Plan options data from CMS Landscape files 2019 through 2024. Population data from the U.S. Census Bureau. AEP data measures change from December 2023 to January 2024.

In February of 2024, Chartis surveyed line of business leaders at 19 unique health plans about their market outlook for 2025 and beyond.

Prior years’ reports had limited data to 50 states. This year’s report includes new and historical data for US territories, though they are not shown on maps.

Notes

1 Blues plans referenced include only those that are nonprofit. Elevance and subsidiary plans are classified as for-profit. Nonprofit plans referenced exclude nonprofit Blue-branded plans and subsidiaries.

2 For purposes of this study, “start-up plans” are those that are or were recently venture-funded or partnered with outside capital to achieve rapid growth through market expansion or partnerships. Some may refer to these organizations as “insuretech.”