In the past year, a growing chorus of disputes has risen between health systems and Medicare Advantage (MA) plans. So far this year, 15 health systems have finalized terminations with MA plans.1 These disputes have ranged from health systems ending a single plan’s MA contract to terminating the entire portfolio of MA contracts.

While conflict between payers and providers is hardly novel, the volume is telling and, we believe, a product of a confluence of compounding pressures currently facing both health systems and health plans.

MA plans are facing mounting headwinds to their core business:

- Rising medical costs driven by increasing utilization are outpacing reimbursement rate increases.

- Regulatory changes to risk adjustment and MA Star ratings methodology are impacting the revenue opportunity health plans traditionally had from these programs.

- Pharmacy liability is shifting from members to health plans under the Inflation Reduction Act. This is forcing plans to reduce supplemental benefits that have been a significant growth driver.

Similarly, health systems are facing pressures of their own:

- Margins have eroded due to increased labor and supply cost.

- The continued growth of government-sponsored lives has eroded health systems’ payer mix, which has historically relied on commercial business.

- Traditional Medicare volumes have been replaced by the increasing penetration of MA, which increases administrative requirements and impacts payment.

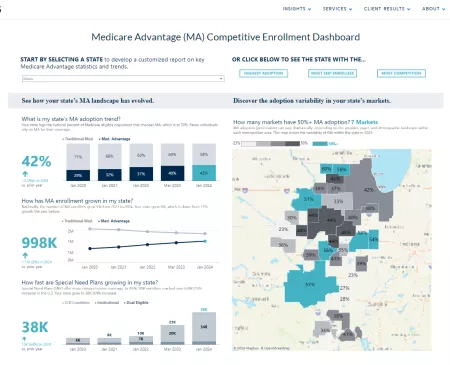

With MA enrollment now accounting for half of the Medicare-eligible population, we believe contract termination is likely to harm the health plan, the health system, and—most importantly—the patients/members caught in the middle.2 While challenging, we believe the issues are navigable. Organizations that find common ground can create a more amicable and mutually beneficial outcome for the health plan, health system, and the patients/members.

Medicare Advantage Growth and Penetration Changes by Year

Two issues are at the core of these disputes

Payment rates, a systemic sticking point, are perceived as unfavorable

Health systems do not believe reimbursement from MA plans is sufficient to cover costs. This challenge is especially pronounced for rural hospitals and academic medical centers, which are accustomed to different (e.g., cost plus) or additional reimbursement from Traditional Medicare. The contracted rates that MA plans pay to providers may be on-par with Traditional Medicare rates. But once prior authorizations and denials are factored in, the final reimbursement from MA plans for services rendered by providers may end up being lower. The increasing rate of denials by MA plans (vs. the change in commercial carriers) magnifies the impact of this issue.

Change in denial rates (January 2022-July 2023)3

While providers are used to accepting lower reimbursement from Traditional Medicare, no one saw it as optional. Given the choice of participating with certain MA plans and not others, providers are increasingly scrutinizing this low-reimbursing volume and looking at private negotiations to solve for its shortcomings.

Prior authorization creates a clinical and administrative burden

Health systems and providers that are terminating MA contracts cite prior authorization requirements as one of their primary frustrations. A recent MGMA survey found that prior authorizations are a significant dissatisfier for providers, with 89% of providers finding the practice “very or extremely burdensome.”4 The total cost of prior authorizations to the healthcare system exceeds $1 billion each year, with 85% of that cost being borne by the providers.5

A KFF analysis found that of the 35 million prior authorization requests submitted to MA plans, 6% (2 million) were fully or partially denied.6 Of these denials, providers only appealed them 11% of the time but were successful in 82% of the appeals.

Further, delays in receiving approval for care can tie up providers’ resources (e.g., inpatient beds), which results in lost revenue opportunity as well as a frustrating experience for providers, staff, and patients due to delays in receiving care.

Health plans and health systems can navigate these sticky issues in four specific ways

1. Establish common goals

Medicare Advantage is here to stay. Individual health systems terminating their MA contracts won’t change the growth and prevalence of MA in most markets. With more than half of Medicare beneficiaries receiving coverage through MA plans, health systems need to participate to fulfill their mission of providing care to their communities. Accordingly, the health plan and health system must start with the foundation that:

- MA is the payer of choice for many seniors.

- Both parties have a common goal to improve the health of the communities they serve.

- Managing unnecessary cost/utilization and clinical variation across both Traditional Medicare and MA is central to fulfilling this mission.

- The current approach to addressing medical spend that is leading to network terminations is not sustainable and is detrimental to all parties.

2. The contracting construct must evolve

Rates are always a tension point between payers and providers. This is exacerbated in MA when health plans apply prior authorizations and denials to a Traditional Medicare payment chassis. Rather than using utilization management as the primary blunt instrument to manage costs, payers and providers should evolve their approach. They should focus on partnership structures in which payers support and value the providers’ ability to avoid unnecessary spend and recognize revenue drivers in MA, such as Star rating attainment and accurate clinical documentation.

This evolved approach should include contracting structures that incorporate the unique payment approach in MA (i.e., risk adjustment, Star rating) and recognize the providers’ contributions to these levers. Recognizing that medical cost savings reduce revenue for the health system, the two parties could explore opportunities to reduce cost outside the health system, such as through pharmacy or skilled nursing facilities. For utilization within the health system’s walls, the two parties could find common ground by focusing on low-value care, clinical variation, or waste.

3. A data-driven approach can change the perspective and role of utilization management

While the evolved contracting approach described above will help address payers’ medical cost concerns, it’s likely that utilization management as a cost control measure can never completely disappear. However, the collaborative use of data can inform a more moderated approach that addresses both parties’ concerns. For prior authorization, plans and providers could start by:

- Identifying the volume of prior authorizations

- Conducting various segmentations (e.g., type of clinical service and provider)

- Determining the denials for these prior authorizations by segmentation

- Quantifying the payment impact and administrative load to manage

This analysis will help both parties understand the value of prior authorizations and make joint determinations on when these areas are necessary and when they might be relaxed.

This information will also help both parties align on a monitoring process. For plans to relax prior authorization requirements, they will need assurances that this will not result in unnecessary care or spikes in utilization. A better understanding of prior authorization drivers and outcomes, and assurances on joint monitoring, can create middle ground for relaxing these requirements.

4. Value the impact of termination

Few instances of contract terminations will create an optimal outcome for either party or the patient/member, though it is possible. MA terminations may artificially restrict access to volumes that provide contribution margin to the health system. Similarly, a health plan terminating a provider may significantly harm its ability to sell a product and manage it profitably. Both parties must inventory and quantify risks to all parties to understand the true impact of taking this step.

Find common ground for the best outcomes

Both parties can agree that the current contracting approach, which is resulting in network terminations and patient/member disruption, is unsustainable. Both parties’ financial concerns have merit and must be acknowledged. However, alignment on the common goals can be a grounding point to move conversations forward productively. Using the steps outlined above to agree on this common ground, create more productive conversations based on data, and evolve the contracting approach is a good place to begin.