Many health systems are struggling to stabilize their financial footing. Doing so in today’s volatile environment requires more than executing incremental operational improvements. It also requires wholesale transformation and redesigning the traditional way of delivering care.

In 2022, more than 50% of US hospitals and health systems lost money due to ripples from the pandemic, hyper-inflation, and workforce instability.1 Average operating margins barely clawed back to the black in 2023 (to 0.5%).2 But numerous organizations remain stuck in a vicious cycle of constant cost-cutting and turnaround efforts to maintain razor-thin margins and protect dwindling sources of capital. Burnout and stress levels are high as executives find themselves constantly fighting operational fires, unable to also focus on strategic issues.

What is the answer for climbing out of this hole—sustainably?

First, health systems must stabilize operations by immediately addressing their most salient sources of loss. Examples include outsized premium labor spend, workforce and span of control inefficiencies, and sub-scale sites or service lines. But executing only these traditional financial improvement efforts is no longer enough.

To achieve lasting financial sustainability, health system leaders must boldly transform their care delivery model, portfolio of clinical services, and physician enterprise. And they must do so in a manner that defends against intensifying market forces and harnesses novel and emerging solutions, such as those listed below.

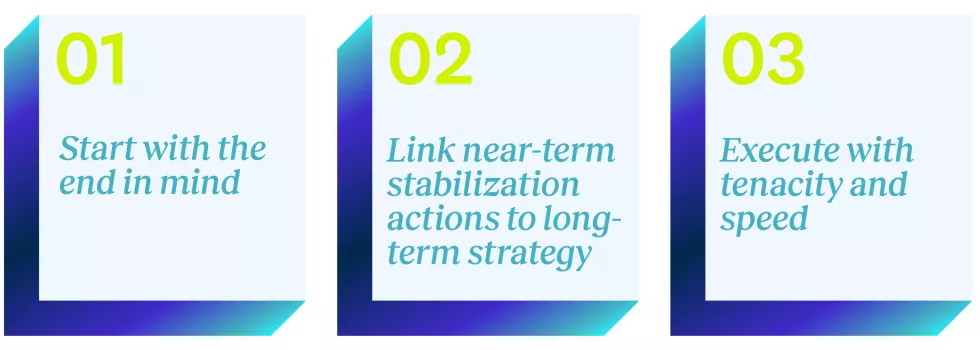

Health system executives must navigate these market forces head on while simultaneously embracing an expanded slate of innovations to stabilize operations and reshape the enterprise. Our playbook discusses three imperatives to actualize this aspiration—and provides examples of initiatives and actions organizations can deploy.

The transformation playbook: Three imperatives

Health system leaders should drive enterprise-wide transformation with three imperatives:

Imperative 1: Start with the end in mind

Organizational strategy must drive the transformation plan. Improving near-term financial performance is important, but creating a health system that is strategically differentiated and financially sound for the foreseeable future is paramount. To do both these things, leaders must first develop a high-level blueprint for the enterprise’s future strategic positioning. While the ensuing work typically requires 1 to 3 years to fully execute, leaders should complete the initial planning exercise rapidly (i.e., 4 to 6 weeks)—not over several months like traditional strategic planning efforts.

Consider launching a rapid planning process with a small group of executives. It should be informed by targeted market and internal analytics, and oriented around the following questions:

- What unique role do we desire to play in our market(s)? How will our financial improvement plan enable (and not encumber) that vision?

- What is the most rational scale and mix of clinical services we should provide in our market(s)? This decision should align the intensity of services offered with the acuity of the community’s health needs—and ensure financial sustainability.

- How should we deploy our employed physicians and APPs differently to achieve performance goals while creating a differentiated patient experience?

- How should we rebalance or reconfigure our asset portfolio to accelerate our strategic and financial improvement goals?

- What assets, clinical programs, and corporate functions should we fully own vs. joint venture (JV) or partner on vs. divest? Leaders should base this decision on their answers to the previous questions and longer-term growth considerations.

Imperative 1: Start with the end in mind

|

|

|

|

While these example actions often require a longer timeframe to implement, leaders should develop high-level hypotheses within the first few weeks of the transformation planning process. They can then use these hypotheses as an overarching strategic framework to prioritize and “screen” the more immediate financial improvement interventions described below.

Imperative 2: Link near-term stabilization actions to long-term strategy

When in the throes of a financial turnaround, organizations must avoid building a performance improvement plan in a vacuum. Rather, leaders must develop the plan in the context of where the organization is trying to go long-term. Once leaders develop their high-level strategic direction, they should rigorously analyze, prioritize, and implement a set of immediate interventions. These interventions should ensure speed to value (i.e., realizable within roughly 60 to 120 days), materially improve cash flow, and shore up sources of reinvestment to channel into the longer-term strategy.

As one example of linking stabilization actions to the long-term strategy, leaders should avoid assigning wholesale expense reduction targets across each department. Instead, they should protect highly strategic programs that have a meaningful and quickly realizable growth thesis or return on investment. In turn, they should assign disproportionate expense management targets to other areas that do not carry the same value proposition.

Imperative 2: Link near-term stabilization actions to long-term strategy

|

|

|

|

Imperative 3: Execute with tenacity and speed

The small window between identifying opportunities and implementing them is often where well-intended transformations lose momentum or fall apart completely. To prevent this from happening, leaders should identify several “quick wins” to begin implementing immediately while the broader opportunity assessment is still underway.

These “quick wins” should be a focused subset of the stabilization actions described above, and should satisfy four criteria:

- They can make a meaningful financial impact.

- They have low execution risk and resourcing needs.

- They can create a positive groundswell and momentum for team members.

- They support the longer-term strategic direction.

Once leaders have identified, prioritized, and sequenced the broader slate of strategic and operational opportunities, they should launch small workgroups to rapidly execute each one. Further, leaders should embrace that it takes a village to pull off a successful enterprise transformation. It requires galvanizing and convening key clinical and administrative stakeholders across the organization to spearhead the work and actualize the value.

Imperative 3: Execute with tenacity and speed

|

|

|

|

Importantly, changing or transitioning clinical services can be difficult, given community need and health equity considerations. As such, leaders must thoughtfully evaluate identified opportunities in the context of the organization’s mission and unique role in the community.

What this playbook looks like in action

A $3.5 billion health system underwent a comprehensive transformation to return to profitability and strategically navigate market uncertainties. Here’s how.

A large integrated delivery network in the Midwest—with more than 20 hospitals and 1,000 employed physicians and APPs—faced intensifying market pressures and industry headwinds. These forces eroded the organization’s financial position over the past 3 years, resulting in a $250 million annual operating loss.

Dozens of team members—from C-suite executives to front-line caregivers—collaborated to develop a comprehensive transformation plan. The plan would not only return the organization to profitability but also redesign its clinical portfolio and physician enterprise to ensure long-term sustainability and mission advancement.

Here’s how the team harnessed this transformation playbook to guide their landmark effort:

Imperative 1:

|

|

Imperative 2:

|

|

Imperative 3:

|

|

Seize the transformation opportunity

Traditional performance improvement initiatives alone can no longer return financially challenged health systems to a steady state. While organizations still must execute incremental operational interventions, they must align them with a longer-term repositioning strategy. This requires boldly reimagining clinical services, assets, and the physician enterprise. It also requires considering partnerships for services and functions that are not core to the organization’s mission.

Enterprise-wide transformation is an ambitious aspiration. It requires asking provocative questions, weighing difficult trade-offs, and making audacious decisions. But the rapidly changing healthcare ecosystem and ever-increasing compression of clinical margins requires leaders to act now and seize this opportunity.

If not now, when?

Sources

1 Chartis analysis of 995 hospitals utilizing Medicare Cost Report Data (excludes COVID-19 PHE funding).

2 Moody’s Municipal Financial Ratio Analysis.